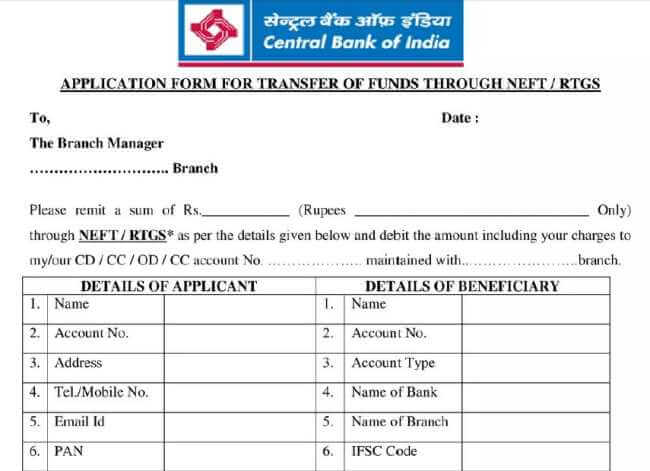

In Part 2, you have to fill the applicant’s name, address, and mobile number. In the second part, the same details have to be filled in the first part. After this, fill the amount and check number also. In the first part, fill the bank name, branch name and account number.

#Sbi bank rtgs form how to#

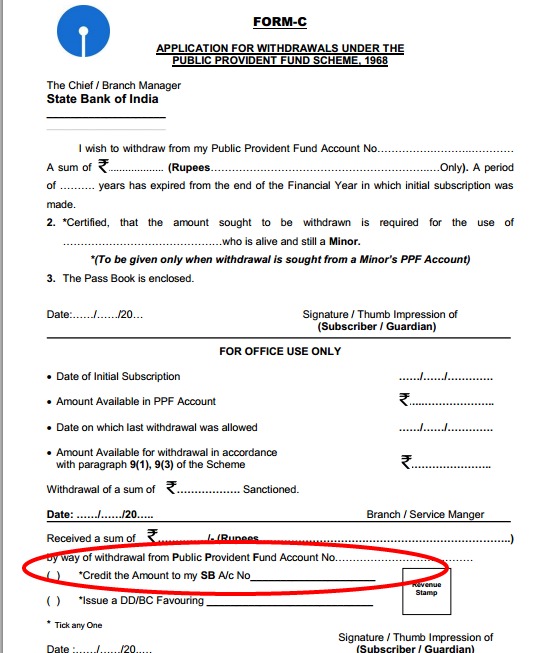

How to fill SBI RTGS / NEFT Application Form?įirst of all, download the sbi RTGS / NEFT application form through the given download link. Here we have told how to download SBI RTGS / NEFT Application Form in PDF? How to Download SBI RTGS / NEFT Application Form in PDF? Form Type This application form is available in the branch. To transfer RTGS / NEFT from sbi branch, you have to fill the application form. With this, you can also avail this facility by going to the bank branch. If you use State Bank of India’s online banking, you can do RTGS and NEFT transfer from home. In RGTS transfer, the money gets deposited in the beneficiary’s account in real-time. On transfer of NEFT, the money gets deposited in the beneficiary’s account within 30 minutes.

#Sbi bank rtgs form pdf#

Still we request customer to intimate Branch Manager if RTGS Account is more than 1 Crore.Download SBI RTGS/NEFT application form PDF : Money can be transferred very easily through RTGS and NEFT facility. While there is no maximum limit for RTGS Transaction.

So ICICI Bank’s minimum limit for RTGS is Rs 2 Lakh. The ICICI Bank offer RTGS service for transaction value more than Rs 2 Lakhs.

What is maximum and minimum limit for rtgs in icici bank? ICICI Bank makes RTGS simple and fasts for its account holders by getting all information at one place, ICICI RTGS form. Reserve Bank of India directly controls the RTGS transactions the fund settlement takes place directly in the books of RBI and for this reason, the payments are final and cannot be reversed.

What is the difference between icici bank and rbi rtgs? ICICI Bank NEFT Form is a form that a person can use to transfer money from one bank account to another and the amount must be less than 2 Lakhs. ICICI RTGS Form is a form that a person can use to transfer money from one bank account to another and the amount must be more than 2 Lakhs. What is the difference between icici rtgs form and neft form? There are three ways to generate your signature: you can draw it, type it, or upload it. These are the simple tips you need to follow to sign the Icici Bank Rtgs Application Form Download Pdf File : Discover the document you need to sign on your device and click 'Upload'. How to sign the icici bank rtgs application form? Date, Bank Name, Branch of the Bank, Account number, Total amount, Words of the Total amount, Bank charges. The customer has to fill up the basic details as mentioned in the application. In RTGS and NEFT form there will be two sections. ICICI Bank RTGS form is filled to transfer more than 2 lakhs funds while the ICICI Bank NEFT form is filled to transfer less than 2 lakhs funds. They just need to fill the ICICI Bank RTGS and NEFT form. These are the tips you need to sign the form right from your iPhone or iPad: How to transfer money from icici bank to different regions?ġ5Now customers of ICICI Banks can send their money without any worry to regions across the country. You will find the application CocoSign has created especially for iOS users.

You can sign the Icici Bank Rtgs Application Form Download Pdf File on your iPhone or iPad, using a PDF file. How to sign icici bank rtgs application form on iphoneipad? To complete ICICI NEFT Transaction you need Beneficiary details and IFSC of the beneficiary bank branch. The ICICI Bank’s NEFT transactions settled in Batch of NEFT transactions. You can download ICICI Bank NEFT / RTGS Form PDF from our website Insuregrams.

0 kommentar(er)

0 kommentar(er)